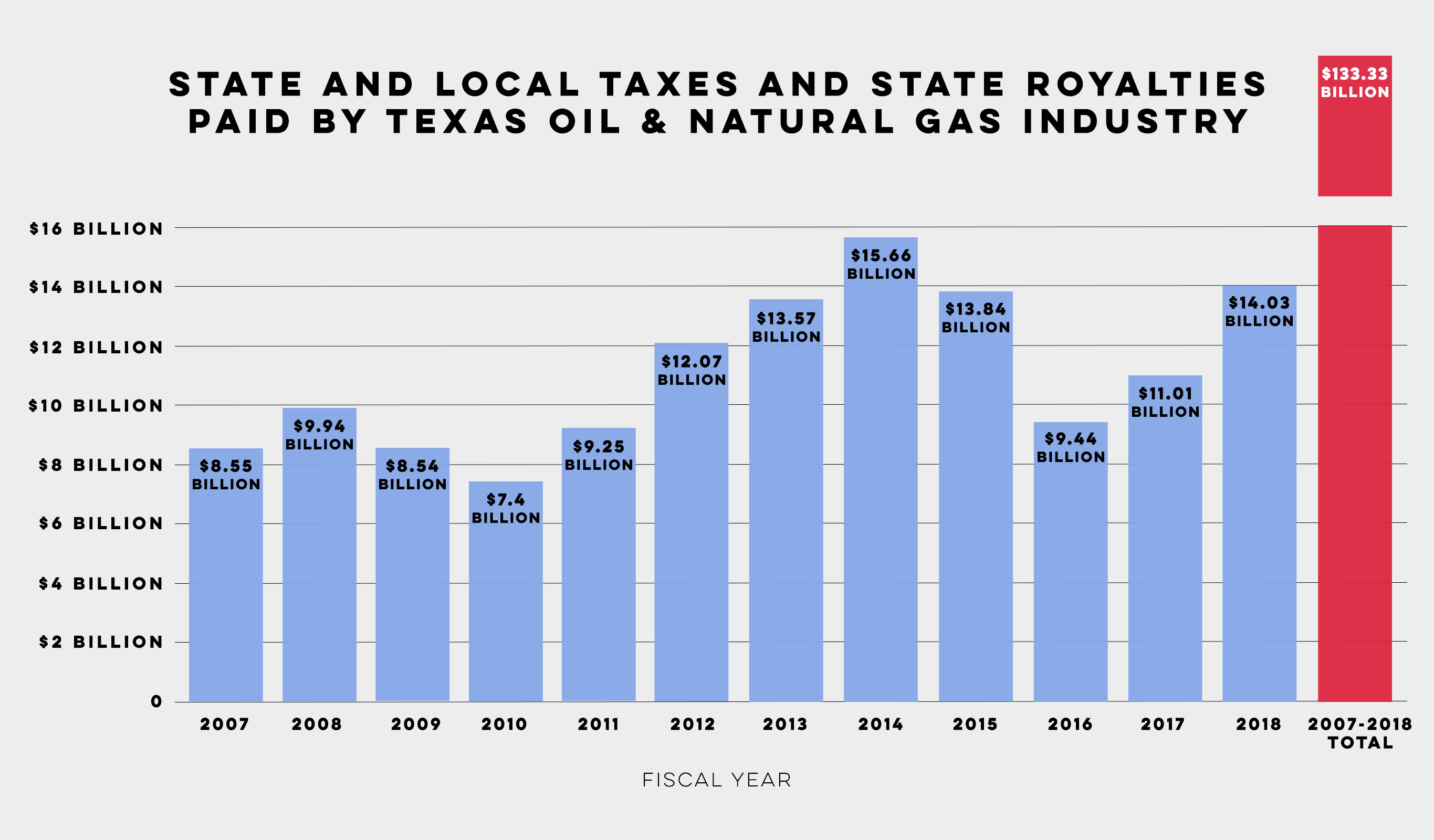

Texas Oil and Natural Gas Industry Paid More than $14 Billion in Taxes and Royalties in 2018, Up 27% from 2017

Staples: As TXOGA Turns 100, Taxes and Royalties from Oil and Natural Gas Hit $133 Billion – Just Since 2007

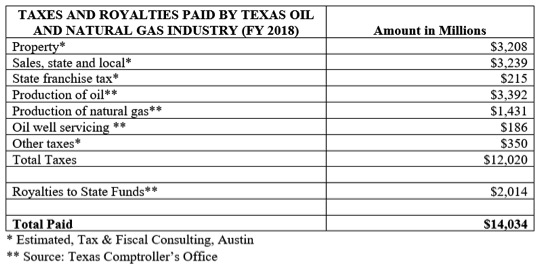

AUSTIN – According to just-released data from the Texas Oil & Gas Association (TXOGA), the Texas oil and natural gas industry paid more than $14 billion in state and local taxes and state royalties in fiscal year 2018, up 27 percent from fiscal year 2017 and the second-highest total in Texas history. TXOGA President Todd Staples hosted a media briefing this morning to share the data as well as the Association’s priorities for the 86th Legislature.

In noting that 2019 is TXOGA’s Centennial Year, Staples said, “As we celebrate 100 years of oil and natural gas, we are proud to report that the Texas oil and natural gas industry has paid $133 billion in state and local taxes and state royalties, just since 2007.”

“Last year alone, the Texas oil and natural gas industry paid the equivalent of $38 million a day to fund our schools, roads, universities and first responders,” said Todd Staples, president of TXOGA. “More tax and royalty revenue from the oil and natural gas industry means our lawmakers have more to work with to meet the needs of our growing state.”

In fiscal year 2018, Texas school districts received $1.24 billion in property taxes from mineral properties producing oil and natural gas, pipelines, and gas utilities. Counties received $366.5 million in oil and natural gas mineral property taxes.

“In addition to taxes and royalties, Texas oil and natural gas companies are investing billions in advanced technologies that are protecting and improving our environment – proof that we can grow our economy, protect the environment and enhance our energy security at the same time,” Staples said. U.S. CO2 emissions are near 20-year lows and methane emissions from oil and natural gas systems are down 14 percent since 1990 – all while production has skyrocketed.

State royalties paid by the oil and natural gas industry in fiscal year 2018 increased 18 percent to a total of $2 billion, money that is used to capitalize the Permanent School Fund (PSF), which benefits the public schools of Texas, and the Permanent University Fund (PUF), which benefits public higher education in Texas. Oil and natural gas royalties constitute the only substantive new money deposited annually to the PSF and PUF, according to Staples.

“What’s remarkable to me is that the Texas Permanent School Fund, seldom recognized outside of Texas, leads the pack among ALL educational endowments in the country,” he said. “With a balance of $44 billion at the end of fiscal year 2018, the PSF is the largest educational endowment in the nation – bigger than Harvard University’s endowment worth $39.2 billion.”

Finally, Staples described TXOGA’s public policy priorities for the 86th Legislature, which include support for adequate funding for the Railroad Commission of Texas and the Texas Commission on Environmental Quality to be properly staffed and equipped, funding for the Texas Department of Public Safety that will enhance public safety on congested roadways in energy-producing areas, reauthorization of the Texas Emissions Reduction Plan (TERP), renewal of Chapter 312, which allows counties and cities to provide temporary property tax reductions for new projects, and additional funding to assist counties in energy sectors that are experiencing increased traffic and road deterioration.

“We recognize that our state’s impressive energy achievements have sparked rapid population growth and created the need for additional funding for county roads,” said Staples. “Considering energy production is providing vast amounts of revenue for state and local governments, specifically the Rainy Day Fund, we think it appropriate to use a portion of funds already collected for repairs and expansions on county roads in our state’s energy sectors.”

+++

Original news release provided by TXOGA at this link.